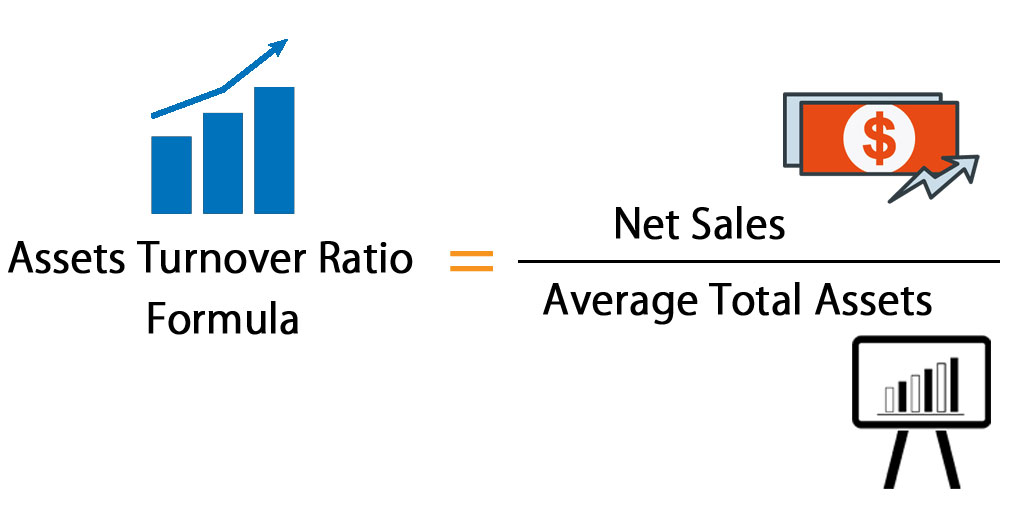

Total asset turnover is a financial metric that measures a company’s efficiency in using its assets to generate sales. It’s a metric that is used to compare the performance of the company’s income statement with the company’s balance sheet. These include white papers, government data, original reporting, and interviews with industry experts.This formula provides a more accurate result by including only the net amount of an organization’s annual sales, after all refunds and returns have been removed from the total sales figure.It is plausible that a company asset turnover ratio for any given year might be higher due to various factors such as selling off assets etc.This efficiency ratio compares net sales to fixed assets and measures a company’s ability to generate net sales from property, plant, and equipment (PP&E).Therefore, to get an accurate sense of a firm’s efficacy level, it makes sense to compare the numbers with those of other companies that operate in the same industry.Investors can use all of this information to get a sense of a company’s TAT and how it has changed over time.In other words, this ratio shows how efficiently a company can use its assets to generate sales. The asset turnover ratio is an efficiency ratio that measures a company’s ability to generate sales from its assets by comparing net sales with average total assets.

Outside investors will use this ratio to compare your company’s performance to others in the same sector.

Your asset turnover ratio measures how effectively your company is using the fixed assets and liquid assets that it has to generate revenue. Asset turnover is a key metric used to describe your company’s financial health.

#Total asset turnover formula professional#

Professional bookkeeping service asset turnover ratio measures how much revenue a company generates from every dollar of the total assets.

0 kommentar(er)

0 kommentar(er)